Property insurance as we know it today can be traced to the

Great Fire of London, which in 1666 devoured more than 13,000 houses. The devastating effects of the fire converted the development of insurance "from a matter of convenience into one of urgency, a change of opinion reflected in Sir

Christopher Wren's inclusion of a site for 'the Insurance Office' in his new plan for London in 1667".

[4] A number of attempted fire insurance schemes came to nothing, but in 1681,

economist Nicholas Barbon and eleven associates established the first fire insurance company, the "Insurance Office for Houses", at the back of the Royal Exchange to insure brick and frame homes. Initially, 5,000 homes were insured by his Insurance Office.

[5]

At the same time, the first insurance schemes for the

underwriting of

business ventures became available. By the end of the seventeenth century, London's growing importance as a center for trade was increasing demand for

marine insurance. In the late 1680s, Edward Lloyd opened

a coffee house, which became the meeting place for parties in the shipping industry wishing to insure cargoes and ships, and those willing to underwrite such ventures. These informal beginnings led to the establishment of the insurance market

Lloyd's of London and several related shipping and insurance businesses.

[6]

It was the world's first

mutual insurer and it pioneered age based premiums based on

mortality rate laying "the framework for scientific insurance practice and development" and "the basis of modern life assurance upon which all life assurance schemes were subsequently based".

[9]

In the late 19th century, "accident insurance" began to become available. This operated much like modern

disability insurance.

[10][11] The first company to offer accident insurance was the Railway Passengers Assurance Company, formed in 1848 in England to insure against the rising number of fatalities on the nascent

railway system.

By the late 19th century, governments began to initiate national insurance programs against sickness and old age.

Germany built on a tradition of welfare programs in Prussia and Saxony that began as early as in the 1840s. In the 1880s Chancellor

Otto von Bismarckintroduced old age pensions, accident insurance and medical care that formed the basis for Germany's

welfare state.

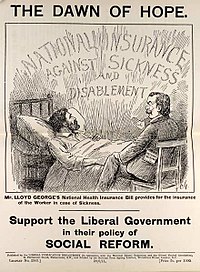

[12][13] In Britain more extensive legislation was introduced by the

Liberal government in the

1911 National Insurance Act. This gave the British working classes the first contributory system of insurance against illness and unemployment.

[14] This system was greatly expanded after the

Second World Warunder the influence of the

Beveridge Report, to form the first modern

welfare state.

[12][15]

Aucun commentaire:

Enregistrer un commentaire